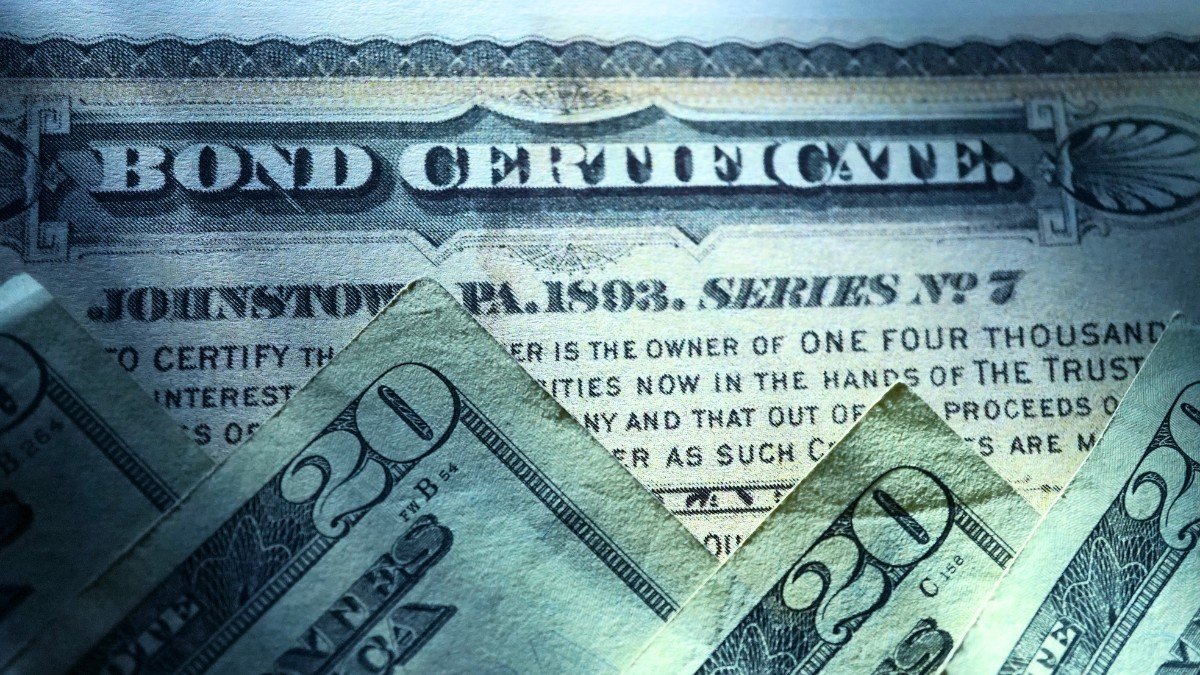

Bond prices are in for a change come 2025, and it is very crucial for U.S. investors to fathom how these movements can transform their holdings. The interest rates are getting higher, the inflation fears are more intense, and the market has been reshaping, therefore, the prices of the bonds are more fluctuating than ever. As an experienced investor or somebody who is just entering the market, it is essential to be well-informed about the possible consequences of these adjustments on your investment strategy and your earnings.

One of the mainstays of conservative investment strategies, bonds, have always provided fixed interest payments over time. Yet, the bond market is on the verge of a new chapter due to the remarkable performance of the economy in response to the reinforcement of U.S. monetary policy and the significant impact of global economic instability. The changes in bond pricing are now the topic under the spotlight, especially in times when more and more investors, driven by the spirit of adaptation to a fast-changing environment, are looking for various new investment options.

How Interest Rates Are Impacting Bond Prices

Underlying bond prices have been a hot topic mainly because interest rates have surged to unexpected heights. The higher the interest rates, the lower the price of existing bonds. This is because with the new bonds in circulation offering a higher interest rate, the old ones with less interest become less appealing. As a result, bond prices are reacting to the situation and, therefore, the face value of the bond falls as interest rates grow.

For instance, in 2025, the Federal Reserve raised interest rates multiple times to combat soaring prices. This has given rise to bond price fluctuations as a result of the increase in interest rates. It is worth mentioning that the prices of the Treasury bonds, corporate bonds, and municipal bonds have all changed. People who had bonds with a low-interest rate are now watching the value of their bonds drop since they can only sell them at a lower price than at maturity only.

Bond Maturity and Its Role in Changing Bond Prices

A bond’s maturity length, the same as its price, is another factor that swaps bond values. The long-term bonds are the most heavily affected when there is a change in the interest rate; it suggests that their prices can be the most unstable. The short-term bonds are less inclined to change in price on a market when the bonds are in the middle of being changed, i.e., the market is less volatile, and hence, they could be a good and a safer vehicle for the risk-averse investor. However, the long-term bonds could be a good choice for a person who is ready to take a risk in exchange for higher yields.

Investors can use the knowledge of bond maturity distribution as a tool for maneuvering through fluctuating bond prices in the market. For instance, a longer maturity date on a bond will result in larger price fluctuations as interest rates remi…

The Impact of Taxation on Changing Bond Prices

Bond prices are indeed moving as a result of changes in the tax environment. Some of the taxable investments like corporate bonds and the tax-free ones, inclusive of municipal bonds may have changes in their relative attractiveness depending upon the change in tax policy. The exemption of municipal bond interest from federal taxes mostly makes them the prime candidate for an investor; particularly the ones in the high tax bracket. As interest rates rocket up and bond prices re-accommodate, the muni bonds can stand to gain a better position in terms of the yield attracting the most compared to other sources of income.

That being said, this is not the situation for all types of bonds. The ones of the private sector are those that the tax authorities require payments from. The payment of taxes will usually leave fewer earnings to the investors from the bond as the tax-adjusted yield will be less than the yield determined before the tax impact. The adjustment of the rates may also result in a change i…

The Changing Bond Market in 2025

We are still in 2025 and the market is showing the fact that the bond prices are changing and this can be attributed to different economic factors like the increase in interest rate, rapid inflation, and modifications in tax policies. One of the most important aspects for entrepreneurs is to stay tuned with the latest market developments, which would also require them to change their strategies. Apprehending how such variations affect the bond yields, duration, and tax implications is a sure way to go for more profitable opportunity and you have the right to be well-informed on the right path.

Not only the bond prices are altered, but it also increases the yield firstly in the Treasury section, and the corporate section lies behind it. What one is seeing in the market can immensely help in avoiding many of the potential problems encountered while navigating one’s financial career.

You can get more information about this on the official website of U.S. Department of the Treasury

Bond Prices Are Changing In 2025- FAQs

1. Why Are Bond Prices Changing in 2025?

The altering of the prices of bonds in 2025 is caused by the Federal Reserve raising interest rates, inflation pressures, and changes in the market situation. Rising interest rates, for example, generally come with falling prices of the existing bonds that, in turn, leads to more volatility in the bond market.

2. How Do Interest Rates Affect Bond Prices?

With the change in bond prices comes the importance of the correlation between interest rates and bond values. The higher the interest rates, the less attractive the old bonds due to the fact that the new bonds with higher interest rates are available. As a result, the prices of existing bonds are likely to depreciate.

3. What Does Maturity Have to Do With Changing Bond Prices?

Bonds with a longer maturity period are the ones that are more responsive to interest rate changes, and it is assumed that bond prices are changing by a larger scale for these types of bonds. On the other hand, short-term bonds, being less volatile, provide a safer haven for purchasable bonds during the interest rate climbing period.

4. Are Municipal Bonds Affected by the Changes in Bond Prices?

Indeed, the bond prices are changing and the influence spreads to all the bond types like municipal bonds. The latter may possess a significant tax advantage, which would be a good reason for an investor to opt for them during the rising interest rates era. However, the bond market is indeed in a turbulent state, affecting the prices of the municipal bonds.